In general a gap loan is a secured loan. Gap funding is one way to use other peoples money and make it work for you.

This allows for rehabbers to complete a project without using any of their own funds yet enjoy profits from the project.

Commercial gap funding. We provide charter and private school operators with the lending sources and guidance needed to obtain facilities financing and solve for the funding shortfalls. Seller Concessions up to 100 Combined LTV allowed. Funding the Gap is a licensed Commercial Mortgage Broker.

Gap Funding Commercial Real Estate Pros Cons When financing commercial real estate acquisition construction or rehab theres usually a requirement to inject cash into the deal. Back-to-back closing problems are now solved by our innovative funding program. With Gap funding is one way to bridge the gap between the cash you have available for a project and the total project cost when a typical rehab loan leaves you with a shortfall.

Innovosource is the resource for university gap funding that regularly tracks over 100 university gap funding program and works with the technology transfer community to inform advocate and. For example if you wish to construct and sell a 5 million office building your typical financing would require you to. In other words you can use gap funding to achieve 100 loan-to-value financing.

There are three main components to a transactional funding deal your purchase your sale and transactional funding. That means gap funding for real estate investors may cover the rest of the acquisition costs in addition to the costs incurred from rehabbing marketing and selling the property. Our loans can also be used to start andor complete renovtions on your existing property without using your investment home as.

Gap Funding for real estate investors flipping houses is crucial to understand to be able to know how fast you can grow and leverage. Gap Funding and Downpayment Assistance Overview Our gap funding program loans allow investors to cover the Gap between the amount funded by a Hard Money Lender and the total amount needed to fund the deal. Wholesale funding differs from the traditional source of funding that a commercial bank would use.

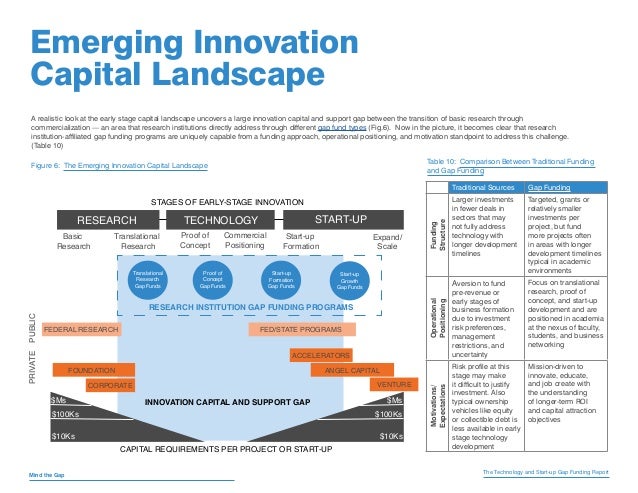

The gap funder lends. Bridge the Gap Funding thrives on providing quick and easy solutions for funding real estate transactions. The Vortechs Group has partnered with innovosource through its Mind the Gap initiative to assist current and aspiring fund managers and stakeholders in the formation and development of gap funds.

We will fund Short Sales REOs residential andor commercial flips in back-to-back closings. It is worth noting however that gap loans typically coincide with more expensive rates than their private and hard money counterparts. Second you will need to have a cash buyer under contract to purchase the property for no less than 5 more than the purchase.

The REIer just has to make sure they have already-lined-up exit-strategy money to get EMD Funding out of the deal in a timely fashion. It allows for cash investors to make much higher returns on their funds. Hard Money 100 Financing.

Viele übersetzte Beispielsätze mit funding gap Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. Value-Add Equity Cashout Rate. Were real estate investors who understand your needs.

3000000 up to 12 Million. The numbers on this deal look like this. You can use gap funding to well plug the gap.

The Gap Funder provides funds required for a renovation project that the Hard Money Lender doesnt cover. First you need a property under contract and earnest money deposited in an escrow account. I explain in todays vid.

It requires a debtor to put up security to obtain the loan. Quickly flip a propertyor fixflip or buyholdif the math works out OK. I would define a gap funder as a private lender willing to lend on a piece of real estate in a junior position to cover the gap between what the primary lender is willing to lend and what the borrower wants or needs to get the deal done.

Investors can put commercial property development sites land auctioned properties residential properties retail stores or any other property as security for the loan. Three main ways investors use Flip Gap First Position Funding to their advantage. An interest rate gap measures a firms exposure to interest rate risk.

Our Gap Loan are unsecured and no collateral is needed. 100 Renovation costclosing costpoints and up to 12 months of interest payments rolled into loan. 90-95 of Total Cost or 75 of Stabilized Value.

Gap funding reduces or eliminates the cash you tie up in the down payment for a real estate loan. If a project is profitable there is a good chance that there is a gap investor willing to work with you on a mutually beneficial transaction.

Gap Funding For Commercial Real Estate Pros And Cons

Gap Funding For Commercial Real Estate Pros And Cons

What Is Gap Funding In Real Estate

Gap Funding Web Summit Innovosource

Gap Funding Web Summit Innovosource

Gap Funding Up To 150k For Grabs Venture Innovations Entrepreneurship

Gap Funding Up To 150k For Grabs Venture Innovations Entrepreneurship

There S A 2 5 Trillion Development Investment Gap Blended Finance Could Plug It World Economic Forum

There S A 2 5 Trillion Development Investment Gap Blended Finance Could Plug It World Economic Forum

Https Www Oecd Org Water Policy Paper Financing Water Investing In Sustainable Growth Pdf

Gap Funding For Commercial Real Estate Pros And Cons

Gap Funding For Commercial Real Estate Pros And Cons

Project Investment Timeline Illustrating The Valley Of Death Funding Gap Download Scientific Diagram

2 Early Stage Funding Gap Download Scientific Diagram

2 Early Stage Funding Gap Download Scientific Diagram

The Ccs Commerical Funding Gap Download Scientific Diagram

The Ccs Commerical Funding Gap Download Scientific Diagram

The Gap In The Market Phiq Group

Gap Funding Unsecured Loans Worldwide Commercial Funding

Cultural Heritage And Sustainable Development An Educators Handbook

Cultural Heritage And Sustainable Development An Educators Handbook

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.