Global markets will shift in 2020 - and all investors need to be prepared according to Hayden Briscoe. What Investors Need to Know - YouTube.

Market Outlook 2020 Global Bonds Asset Management Schroders

Market Outlook 2020 Global Bonds Asset Management Schroders

In SSA field the issuance of green or sustainable bonds was very relevant in the past 3 months.

Bond market outlook 2020. Equity markets rallied strongly and credit spreads yields on corporate bonds relative to lower risk government bonds compressed to near their historically tightest levels. This has been a relatively busy year for the primary market with covered bond benchmark. Only in euro 1416 billion of which 745 by European entities and.

In the first quarter of 2020 January to March the fund was positioned defensively as the managers believed the market was riskier than prices seemed. Crude oil for example is up roughly 70 from October 30 2020 to late March 2021. Bryden Teich and Paul Gardner discuss Avenues outlook for interest rates and Federal Reserve policy as we enter 2020.

However despite 2019 seeing a continuation of falling bond yields the world according to equity and corporate bond or credit investors was in relatively rude health. Covered bond market review and outlook for 2020 Strong primary market in 2019. High-yield bonds the 2020-to-date total return was -57 as of March 10.

Jan03 -- Christian Nolting global chief investment officer at Deutsche Bank. 2020 was a good year for bond prices and for investors who seek bonds to preserve capital. The market has largely recovered from the pandemic-induced liquidity crisis that sent prices.

Energy company bonds comprise roughly 115 of the high-yield bond universe. German and French issuers lead the pack. Despite the damage done during an extraordinary week in March when COVID-19 cases spiked many governors shut down their states and investors sold anything they could to raise cash the Bloomberg Barclays US Aggregate Bond index which tracks the broad US bond market returned 736 as of December 11 2020.

However despite 2019 seeing a continuation of falling bond yields the world according to equity and corporate bond or credit investors was in relatively rude health. The past year saw a significant change in policy from the US. Thats significant because there has never been a bond market as large as Chinas that hasnt been included in.

Do you agree and what are the key risks for bond investors going in 2020. This year we have reduced our allocation to these funds and shifted capital into short-term corporate high yield funds. The base metals price index needs to drop by another 258 to return to its low of.

It is worth noting that MAs industrial metals price index was off by a shallower 103 from January 17 through March 11. Equity markets rallied strongly and credit spreads yields on corporate bonds relative to lower risk government bonds compressed to near their historically tightest levels. The municipal bond market also experienced a significant amount of volatility in 2020.

The combination of economic recovery and higher commodity prices suggests more robust inflation pressures on the horizon and this also makes the rise in bond yields understandable. Until the start of the next cycle of Fed rate hikes I recommend de-emphasizing floating rate bond funds. Further compression in credit spreads which occurred largely in the.

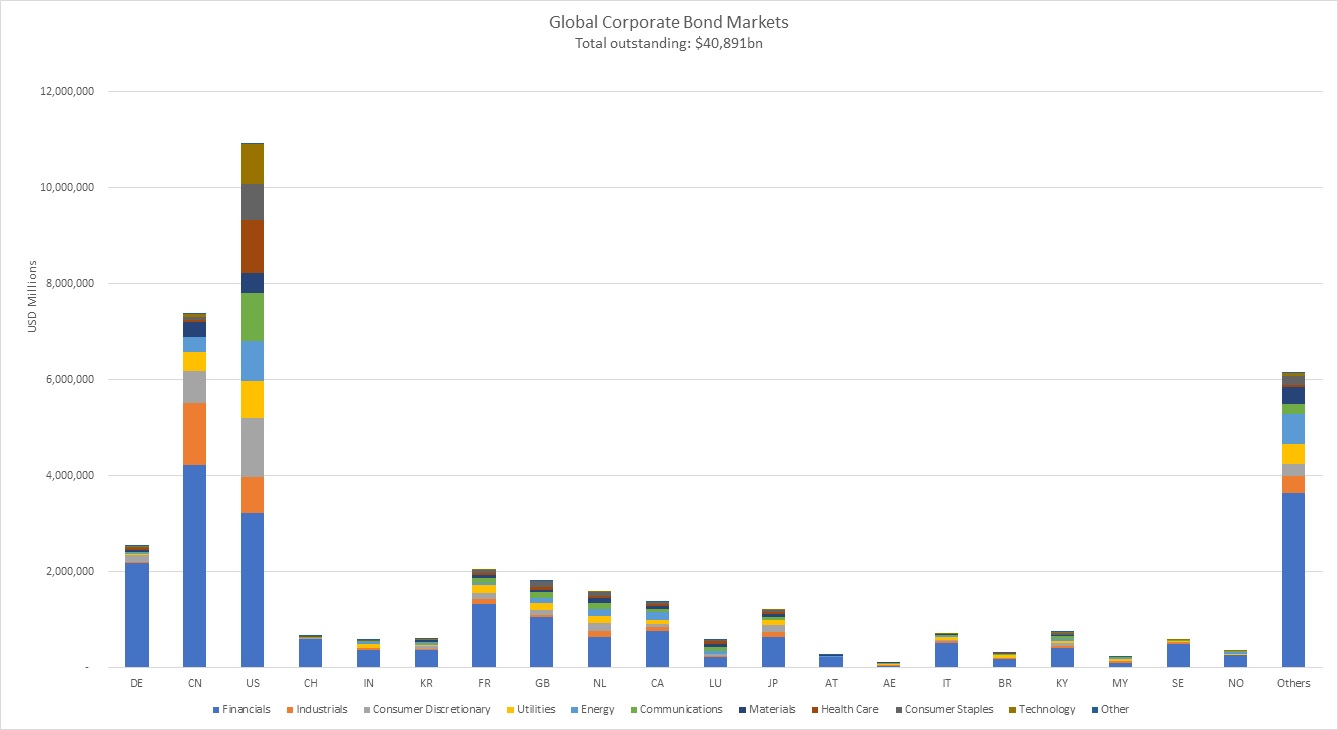

Looking at the countries Germany issuers came in just ahead of French. The Government of Canadas GoC 10-year bond yield at one point fell below 05. The same negative dynamics that plagued both the equity market and corporate bond market in the spring of 2020 impacted the municipal bond market as well.

Treasuries this year may entail a more idiosyncratic. Thats nearly double the indexs 10-year annualized return of 386. Compared to 2020 when global monetary and fiscal policies were focused on supporting solvency and bond investors benefitted from flocking to safe-haven assets such as US.

Global bond indexes are all now including Chinese bonds for the first time. Because of the demand for yield investors could return to this market. Recorded on January 7 2020.

Federal Reserve with three interest rate cuts and a significant re-expansion of their balance sheet starting in September. The conversation touches on the economic outlook for both the. Bond market movements will act as key indicators of the health of the recovery as well as corporate performance and consumer confidence in 2021 and beyond.

2019s strong performance in global bond and credit markets was driven by declines in government bond yields. Page 15 MTS 3 March 2020 Primary markets Having sovereign issuers profited of the good market moment 33 of the 2020 bond issuance programme is completed. Given the evidence from the bond market that the economy is likely to become more sluggish there is little prospect that the Fed will raise rates in 2020.

Junk bonds were routed in early 2020 and like investment-grade credit they rebounded. The Bond Market in 2020. Municipals wrapped up a historic 2020 with broad-market muni indexes up 425 for the year.