Bitcoin is so expensive because it is one of the most arguably the most volatile assets currently on the market. In order to trade Bitcoins youll need to do the following.

A Starter Guide To Bitcoin Options Trading Itsblockchain

A Starter Guide To Bitcoin Options Trading Itsblockchain

Open an account on a Bitcoin exchange eg.

Bitcoin options trading. Trade Bitcoin Options and Futures Bitcoin options and futures have never been better Contract size 001 BTC. Bitcoin options traders have piled into bets that the worlds biggest cryptocurrency will fall below 40000 by next month following an Elon Musk tweet-storm that sent the price tumbling to around. Trade bitcoin derivatives 24x7 on one US regulated platform.

Je zult eerst bitcoins bij een normale Bitcoin exchange moeten kopen en deze vervolgens storten op je Deribit bitcoin-handelsrekening. Deribit has a simple user interface that displays a variety of bitcoin options including expiry dates and strike prices. Jetzt hast du hierfür zwei Optionen.

Learn about bitcoin trading. Bitcoin options trade on Oct. Go to Live Options Trading.

This makes implied volatility IV an important tool when valuing options. The platform was founded in 2016 by John Jansen a former trader on the Amsterdam futures exchange. On the other hand the risk.

Buy or short sell Thats Bitcoin trading in a nutshell. Wo kannst du Bitcoin Trading durchführen. Het is een prachtig handelsplatform maar een nadeel is dat een handelsrekening alleen met bitcoin kan worden gefinancierd.

On the most liquid Crypto Options Trading Platform in the world. Bitcoin options are a way for traders to bet on the price of bitcoin using leverage or to hedge their digital asset portfolio. Bitcoin as a commodity in binary options trading With the current recognition of Bitcoin and its acceptance as a currency many binary options platforms began utilizing Bitcoin as one of many currencies to trade.

Now bitcoin options are being slowly introduced by some regulated institutions although not every provider will have an offering so its important to check where you can trade bitcoin options. Beide Optionen haben ihre Vor- und Nachteile dennoch empfehlen wir dir gerade als Einsteier und Bitcoin Trader einen Broker zu nutzen. Bitcoin options have been trading on cryptocurrency exchanges for a while but were not regulated.

Den Handel mit Zertifikaten und den tatsächlichen Kauf und Verkauf von Kryptowährungen. CEXio eToro Bitstamp Verify your identity. Fastest exchange engine in the industry.

Deribit In dollar terms the per-contract premium at the time was around 3990 and the entire trade required an initial outlay of approximately 638400. Bitcoin-Options2 sind eine Form von Finanzderivaten die Ihnen das Recht aber nicht die Verpflichtung geben den Bitcoin zu einem bestimmten Preis dem sogenannten Ausübungspreis zu einem bestimmten Verfallsdatum zu kaufen oder zu verkaufen. W eltweit gibt es mehr als 8000 Kryptowährungen.

If you want a really detailed explanation keep on reading. Trade via web interface mobile or via the fastest API in the industry. Bitcoin options trading is also a relatively low risk as compared to futures trading since the maximum risk of an option contract is the premium that they had paid.

Deribit geeft je de mogelijkheid om te handelen in Bitcoin vanilla options futures. Deposit money to your account. Für Bitcoin-Trading gibt es zwei Formen.

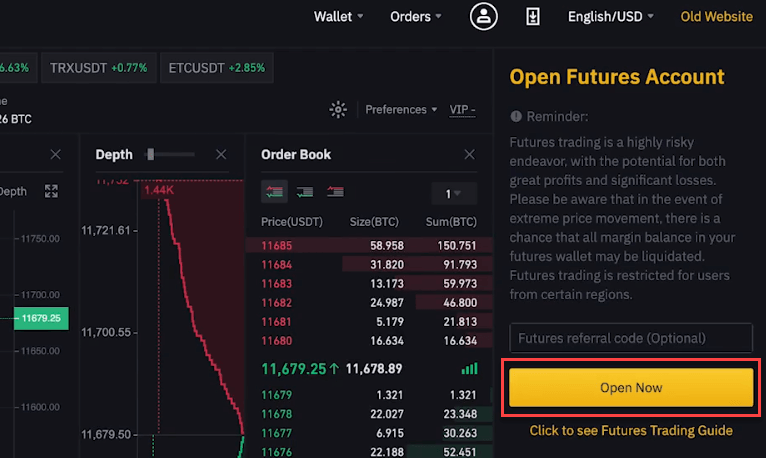

Für den Kauf einer Option. Deribit is an Amsterdam-based bitcoin futures and options exchange. Open your first position on the exchange ie.

Die jüngste Ergänzung der Trading-Instrumente sind Bitcoin-Optionen. In this guide youll discover what bitcoin options are why they are popular for traders and how you can get started with Bitcoin options trading in the United States. Einen Krypto-Exchange oder einen regulierten Broker.

When IV rises the price of the option does too. Ultra fast trade matching engine. A key difference with Bitcoin options trading is the cost.

With less than 1ms latency. Stockbrokers are seeing the worth in trading BTC in opposition to fiat currencies primarily versus American dollars.