A definite criterion is developed in terms of programmable code and placed in the automated platforms to execute trades in the financial markets. We are going to trade an Amazon stock CFD using a trading algorithm.

Algorithmic Trading Strategy Case Study

Algorithmic Trading Strategy Case Study

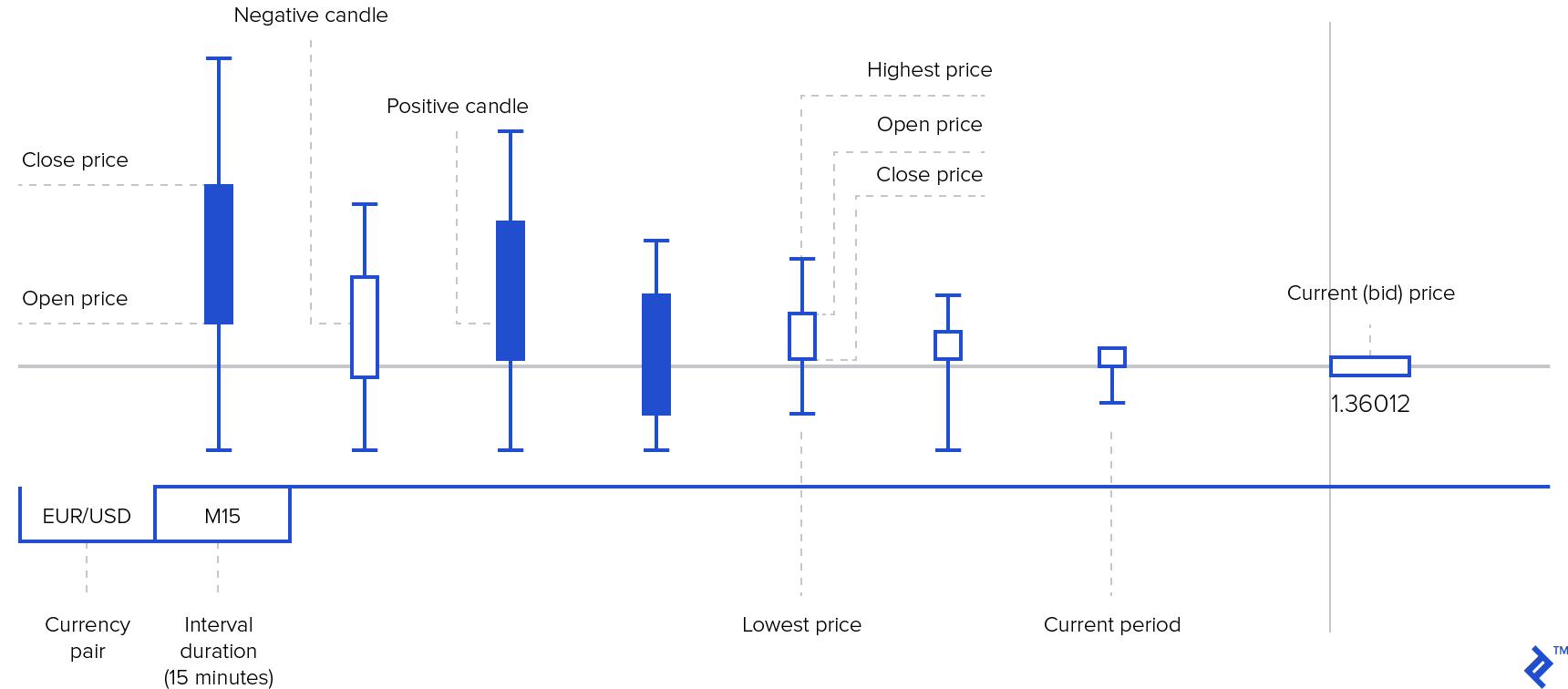

Algorithm trading also known as automated trading or black box trading is a systematic functioning of using computers which have been designed and programmed to follow a particular bunch of directives for making a trade with the sole purpose of making money at speeds which have been deemed impossible for a human investor or trader.

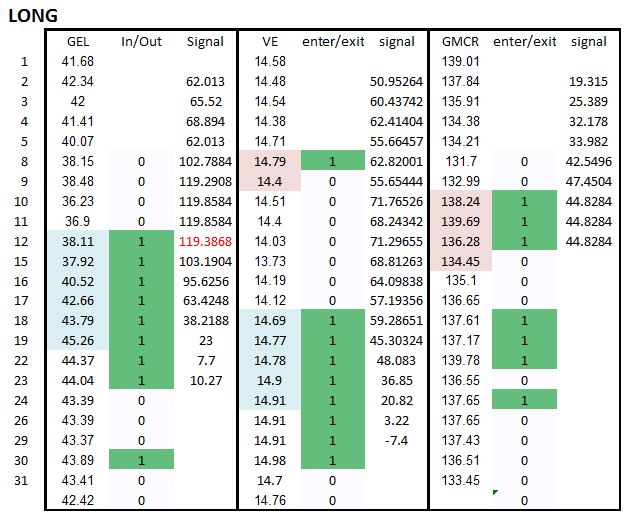

Trading algorithms examples. The strategy is to buy the dip in prices commonly known as Buy the fing dip or BTFD. The specified rules have been defined. Examples of Simple Trading Algorithms.

When a set of pre-set conditions are met. Quantivity detailed mathematical explanations of algorithms and their pros and cons. On Wall Street algorithmic trading is also known as algo-trading high-frequency trading automated trading or black-box trading.

Buy 100000 shares of Apple AAPL if the price falls below 200. Here are some examples of Trading algorithms. Algo-trading can be backtested using available historical and real-time data to see if it is a viable trading strategy.

To learn more about trading algorithms check out these blogs. Although this example algorithm is named like HFTish it does not act like the ultra-high speed professional trading algorithms that collocate with exchanges and fight for nanoseconds. Quantstart they cover a wide range of backtesting algorithms beginner guides and more.

Investopedia everything you want to know about investment and finance. For every 5 pip fall in GBPUSD increase the short position by 1 lot. For every 5 pip rise in GBPUSD cover the short by 2 lots.

Types of Trading Algorithms Expert Advisors EA A simple wizard an Expert Advisors alerts the Trader when a market opportunity is detected ie. The final decision and the execution of the transaction remain in the hands of the Trader. Very hard to say because of one reason.

Short 20 lots of GBPUSD if the GBPUSD rises above 12012. Algorithmic Trading is a perfect skill to pick up if you are looking for a sustained source of income outside of your full-time job. These sniffing algorithmsused for example by a sell-side.

Almost nobody even think about give away a lets say 90 algorithm to the public for everybody to use it. Algorithm trading is a mechanism that facilitates buy and sell orders in the financial markets by using an algorithm which is executed by means of computer programs. What is Algorithmic Trading.

Because of that its almost impossible to make a good guess about that too less information availib. Algorithmic trading is a technique that uses a computer program to automate the process of buying and selling stocks options futures FX currency pairs and cryptocurrency.