The main advantage to a Roth IRA is that once you have kept a contribution for the seasoning period 5-years the last time I checked you can withdraw the contribution without tax you already paid the taxes or. Your accounts would collectively end the year at 12960.

The Benefits Of A Backdoor Roth Ira Financial Samurai

The Benefits Of A Backdoor Roth Ira Financial Samurai

1 And those are just a couple of the benefits of a Roth IRA.

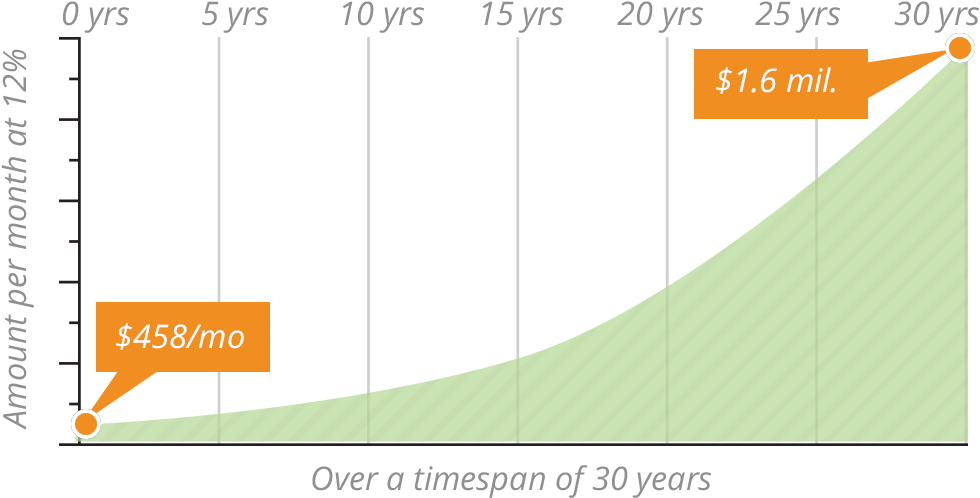

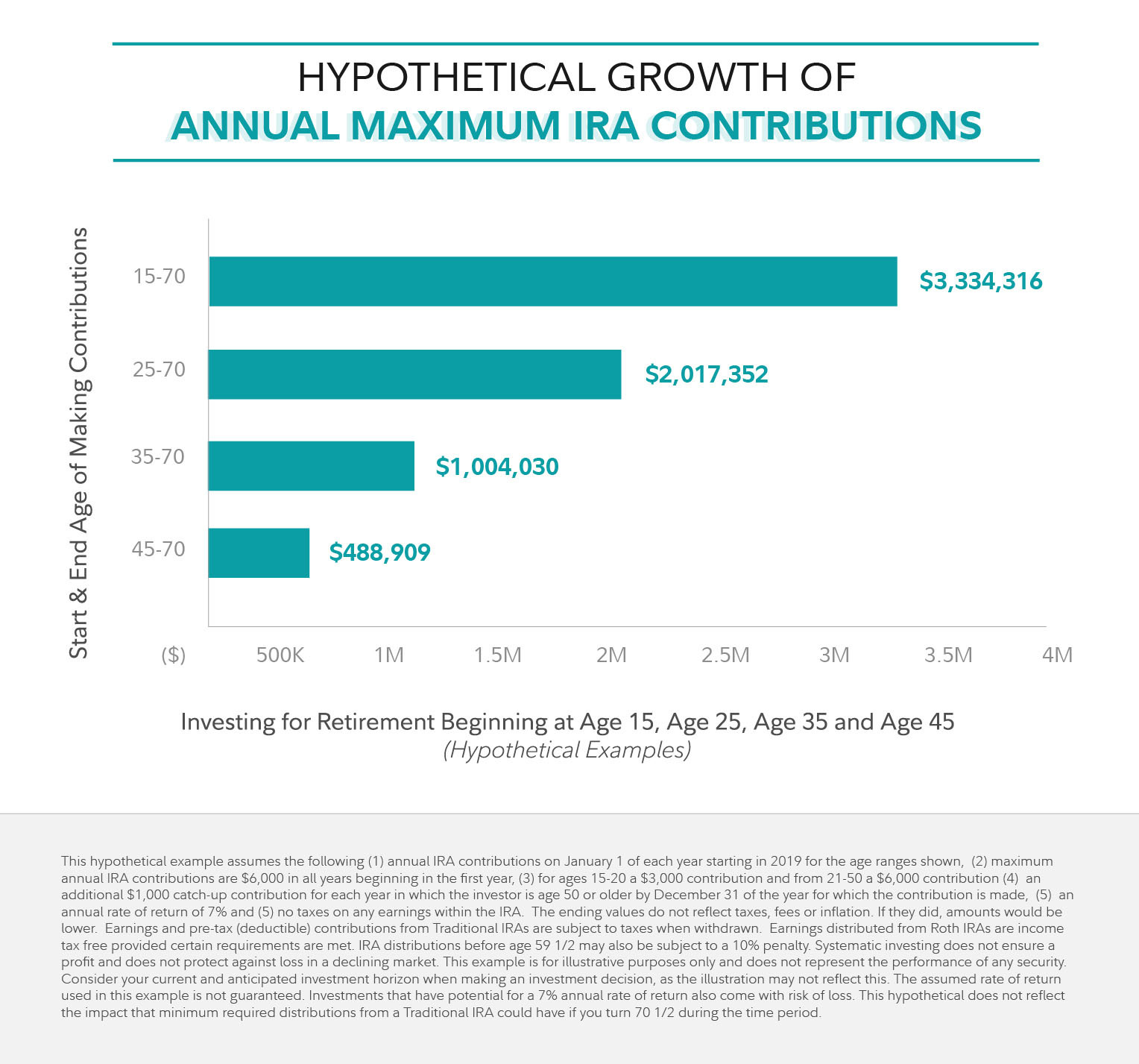

Roth ira growth chart. For most kids 18 and up if they get 5000 its going toward college not toward a Roth. That is a million tax free dollars. As you can see from the chart above you only need to contribute 6000 per year but the account will earn millions.

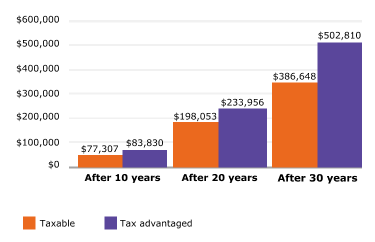

When you contribute money to your Roth IRA it goes into investments of your choosing and you arent taxed on your earnings. The major difference between Roth IRAs and traditional IRAs are that contributions to the former are not tax-deductible and contributions not earnings may be withdrawn tax-free at any time without penalty. The earnings from a Roth IRA grow tax-free so qualified distributions withdrawals are not taxed.

The chart below illustrates how annual Roth IRA contribution amounts may potentially grow into impressive sums over many years. The value of your Roth IRA will rise and fall with the stock market but over its lifetime you should see a steady growth trend. Put up this chart and stay focused on maxing out your Roth IRA every year.

Hypothetical pre-tax growth of annual maximum IRA contributions Despite the potential to accumulate significant savings tying up money in a Roth IRA may not appeal to a child who is more concerned about having cash to go to the movies or to buy video games. The next year the combined balance would be 25920. Other than that one rule there are no required withdrawals for Roth IRAs.

Just continue making regular contributions and stick with it despite possible market changes. You can split your annual elective deferrals between designated Roth contributions and traditional pre-tax contributions but your combined contributions cant exceed the deferral limit - 19500 in 2021 and in 2020 and 19000 in 2019 26000 in 2021 and in 2020 and 25000 in. When you withdraw money from your Roth IRA later on during retirement you dont have to pay taxes on the.

Both the Original black background and the Outline versions in one file you get both automatically. Use our Roth IRA calculator to determine how much can be saved for. Year Now 2037 2052 Balance 0 270K 540K 810K 11M 13M 0 01 02 03 04 05 06 07 08 09 1 Now 2037 2052.

For example if you invest 1000 in your Roth IRA in a certificate of deposit earning 2 per year youll earn 20 in interest that first year. Roth IRAs were first introduced and established by the Taxpayer Relief Act of 1997 and is named after Senator William Roth. Your fund can continue to grow long-term with only upfront taxation.

By changing any value in the following form fields calculated values are immediately provided for displayed output values. Over 30 years if you invest the annual max of 6000 into a Roth IRA it could grow to 14 million. Since you contribute with after tax money a Roth IRA can grow tax free.

Keep in mind that as of 2021 you can. If your income is over the limits you still may be able to have a Roth IRA by converting existing money in a traditional IRA. Which brings me to point 2.

Tax-Free Growth with the Roth IRA. One of the reasons that the Roth IRA is such a great retirement savings tool is that your money grows tax-free. A Roth IRA with its tax-free growth potential and tax-free withdrawals for you and your heirs is a way you may be able to do just that as long as certain requirements are met.

The calculator will also show you the value of the Roth IRAs tax-free investment growth that is done by making a comparison of your projected Roth IRA balance at retirement with the balance you would have if you need a taxable account. The Roth IRA provides truly tax-free growth. Assume you contribute 3000 to your Roth IRA each year for 20 years for a total contribution of 60000.

Lets say your Roth IRA accounts earn interest at an 8 compounded rate. There is no limit to growth. This is a huge benefit for me.

Everyone should have a Roth IRA even if you have a company 401k or company pension plan. There is no tax deduction for contributions made to a Roth IRA however all future earnings are sheltered from taxes under current tax laws. The Roth IRA can provide truly tax-free growth.

If you reinvest that 20 and your original 1000. If you open a Roth IRA and fund it with 6000 each year for. Not everyone can contribute to a Roth IRA because of IRS income limits.

If you are a student with an unpaid summer internship you LEGALLY NOT FUND your Roth IRA. Same as traditional IRAs Roth IRA account holders can take funds penalty-free after 59 ½. The Roth IRA annual contribution limit is 6000 in 2020 and 2021 7000 if age 50 or older.

Roth IRA Growth Example. Use our Roth IRA calculator to determine how much can be saved for retirement. At the end.

The difference is that Roth IRA owners need to contribute to their account for at least five years. Of course with a summer job paying 8 per hour thats 4 to 5 months of near-full-time work so some people may be able to swing it but youd have to put 100 of that income into a Roth IRA. So every dollar your money earns can be withdrawn in retirement without being taxed.

You have to be able to afford to put 5000 into your Roth IRA. 5 Roth IRA Calculator Templates in PDF 1. The best part is your contributions would only total 180000 and the rest12 millionwould be growth.

Roth IRA Balance at Retirement. A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement. Also it is possible to pass a Roth IRA to your family members.

What S Best Traditional Ira Vs Roth Ira Familywealth

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Systematic Partial Roth Conversions Recharacterizations

Systematic Partial Roth Conversions Recharacterizations

Brilliant Ideas Of Roth Ira Growth Chart Easy Roth Roth Ira Growth Chart Full Size Png Download Seekpng

Brilliant Ideas Of Roth Ira Growth Chart Easy Roth Roth Ira Growth Chart Full Size Png Download Seekpng

Spoil Your Grandkids With A Roth Ira Weiss Ratings

Spoil Your Grandkids With A Roth Ira Weiss Ratings

Ira Information Types Of Iras Traditional And Roth Wells Fargo

Ira Information Types Of Iras Traditional And Roth Wells Fargo

Roth Ira Chart Age How Does A Roth Ira Become Larger Exposed To Time

Roth Ira Chart Age How Does A Roth Ira Become Larger Exposed To Time

A Fully Funded Roth Ira At Age 18 Could Net You 3 5 Million Dollars No Credit Needed

A Fully Funded Roth Ira At Age 18 Could Net You 3 5 Million Dollars No Credit Needed

What If You Always Maxed Out Your Ira Dqydj

What If You Always Maxed Out Your Ira Dqydj

Fidelity Investments Continues To Strengthen Ira Leadership In 2019 Millennials Lead Charge With 43 Of Roth Iras Receiving Contributions Business Wire

Fidelity Investments Continues To Strengthen Ira Leadership In 2019 Millennials Lead Charge With 43 Of Roth Iras Receiving Contributions Business Wire

/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png) The Best Retirement Plans To Build Your Nest Egg

The Best Retirement Plans To Build Your Nest Egg

Why You Should Save Money In A Roth Ira When You Re Young

Roth Iras How To Optimize Yours For 2021

Roth Iras How To Optimize Yours For 2021

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.