However one caveat to the tax advantage of muni bonds being tax-free is the AMT alternative minimum tax amount. Federal income taxes and the federal alternative.

The Role Of Taxable Municipal Bonds In Investor Portfolios Seeking Alpha

The Role Of Taxable Municipal Bonds In Investor Portfolios Seeking Alpha

However interest on some municipal bonds is subject to both federal and state income taxes.

Muni bond etf taxes. Rareview Tax Advantaged Income ETF. In some cases the dividend stream from muni bonds is taxable if it falls under the AMT. Most of them are exempt from federal taxes and some are tax-free at the state and local level as well.

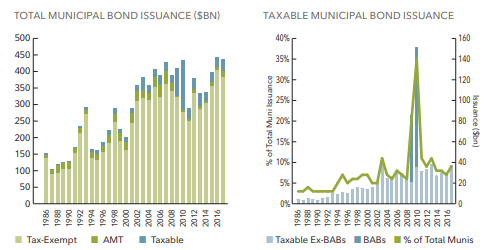

Interest income from muni ETFs that hold only tax-exempt bonds is free from federal tax. The market for municipal bonds may be less liquid than for taxable bonds. Municipal bonds and tax-exempt debt are no longer synonymous a.

This index includes municipal bonds from issuers that are primarily state or local governments or agencies whose interest is exempt from US. Determining Tax-Equivalent Yields. Most munis pay interest that is exempt from federal and potentially state income taxes.

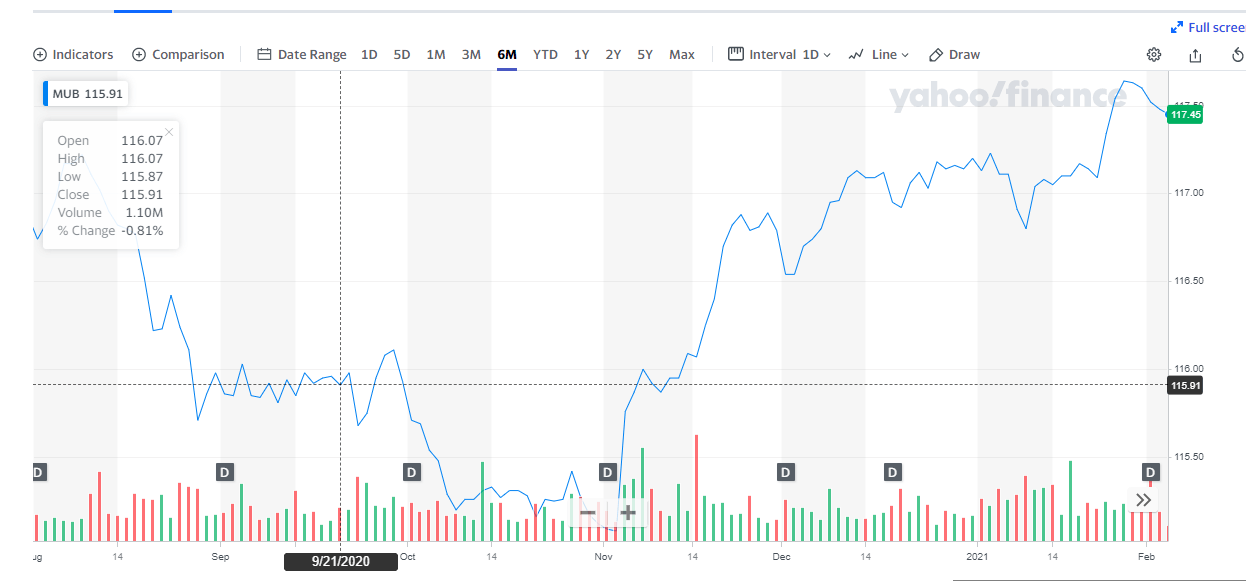

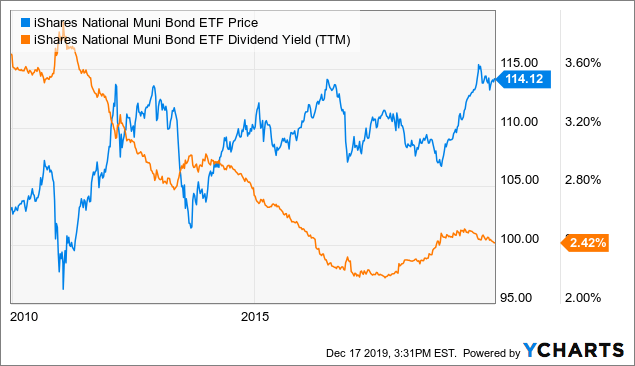

Exchanges that are currently tracked by ETF Database including applicable short-term and long-term capital gains rates and the tax form on which gains or losses in each ETF will be reported. Use to seek tax-exempt income Effective March 1 2016 MUB changed its fund name from the iShares National AMT-Free Muni Bond ETF to the iShares National Muni Bond ETF. 29 rânduri These exchange-traded funds own municipal bonds with coupons mostly.

Capital gains distributions if any are taxable. Default rates regularly run a lean 01 to 02. IShares National AMT-Free Muni Bond ETF provides tax free income beneficial for those investing in a taxable account but its yield lacks the juice to make it most beneficial.

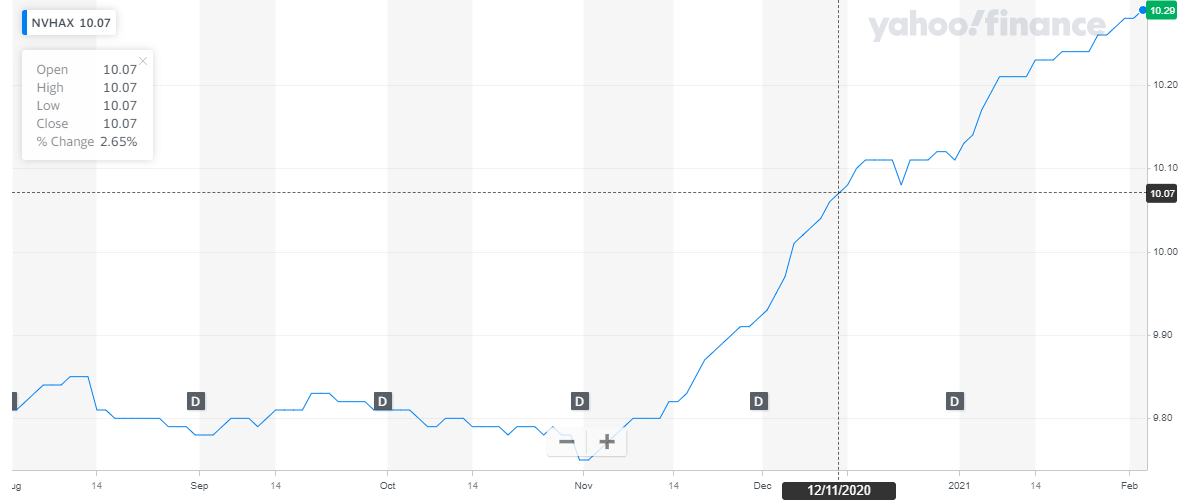

One way to help determine whether a municipal bond fund is the right investment for you is known as the tax-equivalent yieldFor example a taxable bond such as a corporate bond that pays 5 may initially seem more attractive to an investor who also has the option to buy a tax-free municipal bond that pays 4. Exempt from Federal Taxes and Possibly State and Local Taxes Most muni bonds are free from federal income tax. Shares of ETFs are bought and sold at market price not NAV and are not individually redeemed from the fund.

These bonds known as taxable municipal bonds generally pay higher interest rates than tax-exempt munis to make up for the lack of tax benefits. Its a fixed-income darling for tax-sensitive investors. 1 Municipal bonds also called munis help build infrastructure in your area.

The following table includes certain tax information for all Municipal Bond ETFs listed on US. Most high bracket investors love the idea of tax-free muni bonds. Municipal bonds or munis are debt instruments issued by states municipalities or counties for the purpose of financing public capital expenditures such as the construction of highways.

Taxation of Municipal Bond ETFs Exchange-Traded Funds. But they arent sure where to buy them and often end up using exchange traded. However with muni bonds you are investing in a local government so muni bond and ETFs are tax-free.

Taxable munis are one area that ETF investors can leverage with a fast-growing space in the municipal debt or bond markets. Theyre often also tax-free to residents of the issuing state. Some investors may be subject to federal or state income taxes or the Alternative Minimum Tax AMT.

An ETF is a basket of securities in this case municipal bonds that trades as shares on a stock. This limitation may have you looking for other ways to manage your tax billand munis are well-known for delivering tax-exempt interest. Against this backdrop below we highlight a few muni bond ETFs that offered decent returns past month with decent yields.

INVESTMENT OBJECTIVE The iShares National Muni Bond ETF seeks to track the investment results of an index composed of investment-grade US. Impressive Muni ETF Yields 74 Tax-Free and Pays Monthly by ETF Base on March 8 2010 The high yield muni market in general has been a stellar performer following the trough of the 2009 financial collapse but there are some striations depending on just which municipalities are.

How To Pick The Right Muni Bond Etf Etf Com

How To Pick The Right Muni Bond Etf Etf Com

How To Pick A Muni Bond Etf Etf Com

How To Pick A Muni Bond Etf Etf Com

Municipal Bonds Don T Ignore With Higher Taxes And Budget Relief Ahead Seeking Alpha

Municipal Bonds Don T Ignore With Higher Taxes And Budget Relief Ahead Seeking Alpha

Municipal Bond Etfs Could Benefit From Tax Hikes Nasdaq

Municipal Bond Etfs Could Benefit From Tax Hikes Nasdaq

Strong Demand For Muni Etfs Etf Com

Strong Demand For Muni Etfs Etf Com

Municipal Bonds Don T Ignore With Higher Taxes And Budget Relief Ahead Seeking Alpha

Municipal Bonds Don T Ignore With Higher Taxes And Budget Relief Ahead Seeking Alpha

Look Muni Bonds For High Yields Low Taxes Mub Etf Daily News

Look Muni Bonds For High Yields Low Taxes Mub Etf Daily News

Municipal Bond Etfs Could Benefit From Tax Hikes Nasdaq

Municipal Bond Etfs Could Benefit From Tax Hikes Nasdaq

For Debt Stability And Tax Exemption Consider Muni Bond Etfs

For Debt Stability And Tax Exemption Consider Muni Bond Etfs

Mub Etf A 2 Tax Adjusted Return Is Not Worth The Risk Etf Trends

Mub Etf A 2 Tax Adjusted Return Is Not Worth The Risk Etf Trends

How To Pick A Muni Bond Etf Etf Com

How To Pick A Muni Bond Etf Etf Com

With Higher Taxes And Budget Relief Ahead Don T Ignore Municipal Bonds Investing Com

With Higher Taxes And Budget Relief Ahead Don T Ignore Municipal Bonds Investing Com

What You Get With Muni Etfs Etf Com

What You Get With Muni Etfs Etf Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.