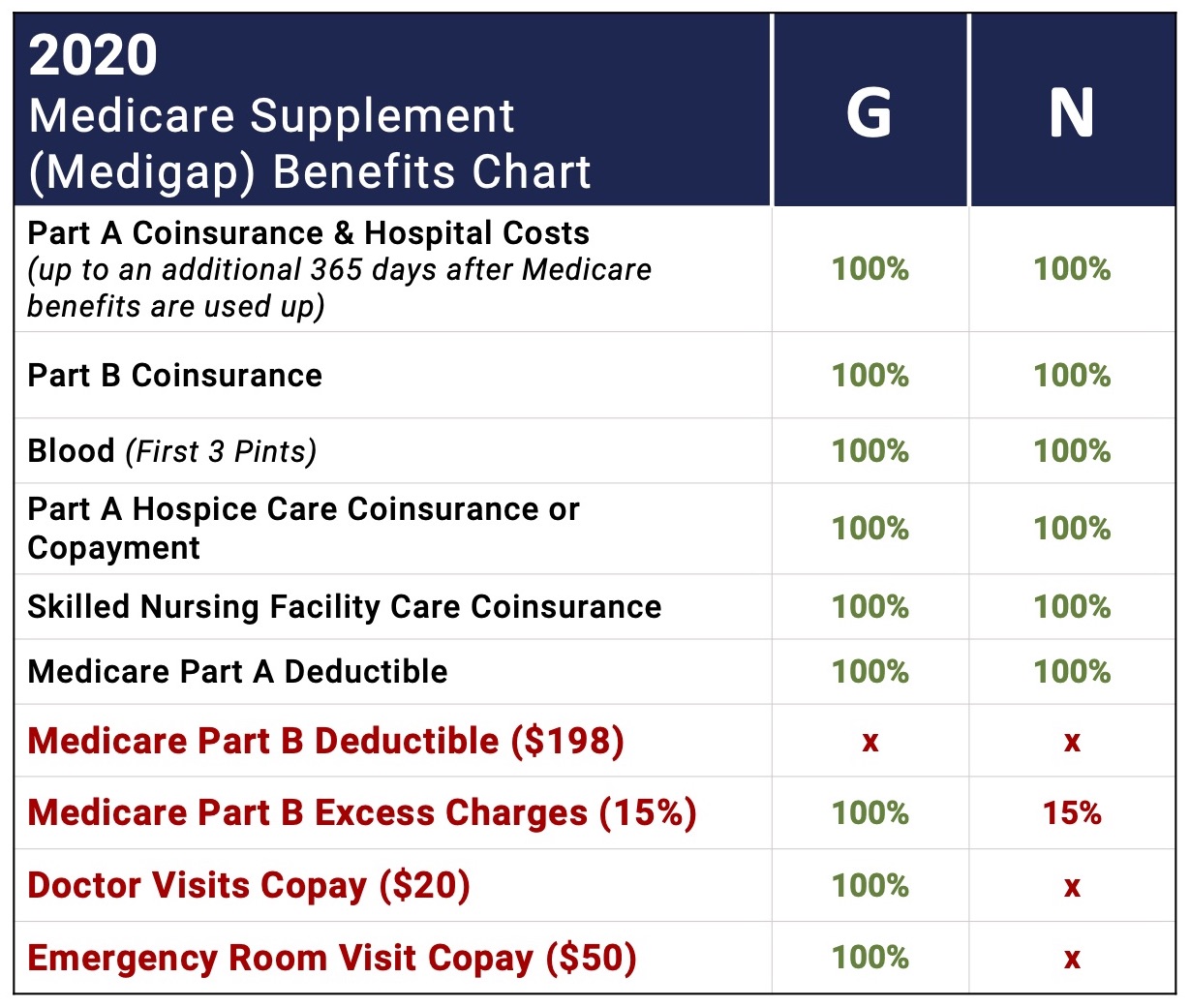

Medigap plans help a person pay their out-of-pocket Medicare expenses. The next most comprehensive plan is Plan G which covers nearly as much with the Part B deductible being the only difference.

Medicare Plan N Vs Plan G Which Is Better Freemedsuppquotes

Medicare Plan N Vs Plan G Which Is Better Freemedsuppquotes

Since Plan G typically has a more expensive premium it actually may save you money in the long run.

Difference between plan g and n. Contents Of This Video 000 Plan G vs Plan N204 What they cover306 Excess Charges Explained508 Coverage Differences546 Price Differ. After paying the 185 deductible you are still saving 115 a year. If playback doesnt begin shortly try restarting your device.

In exchange for a lower monthly premium you agree to pay small copays when visiting the doctor or hospital. For example if a Plan F is 150 a month 1800year and the Plan G is 125 a month 1500year the difference yearly is 300. Plan G includes the following.

Although both of look pretty similar there are some major differences between them which is must to know. Plan N Medicare Supplement - Which is better. Medigap Plan F provides many of the same benefits as Plan G with some differences.

The reason G costs more is because it provides more coverage. Plan G is usually more expensive than Plan N. A person can get a Medigap plan.

Depending upon the condition of your health it might be a better idea to sign up for Plan N even though there is a copay and may be 15 in excess charges associated with it. Plans and policies are integral part of any health system or organization. The glaring difference between a Plan N and a G is the copayments you have with an N as well as potential excess charges.

Medigap Plan G offers all of the same benefits as Plan F except for the Part B deductible. In most States a provider can charge you over and above Medicares Approved Amount however in Pennsylvania providers cannot bill or. 19 of people with Medicare Supplements in 2018 bought a Plan G up 4 from the previous year.

Plan F is a good choice if you visit the doctor frequently and expect to face many out-of-pocket expenses. However Plan N will come with a lower monthly premium. Medicare Supplement Plan N Medigap Plan N covers the same benefits as Plan F except the Part B deductible and Part B excess charges.

All the benefits of Plan F except Part B deductible. Part B excess charges at 100 explained below Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. Visits and you also pay your own excess charges.

Many people are switching to the Plan G due to these savings. Finally Plan N is probably the third most popular plan because it operates similar to Plan G except that you pay copays for doctor and ER. Medicare Supplement insurance Plan G typically covers everything that Plan N covers listed above as well as.

So if you prefer to pay out less as you use the benefits then Plan G may be better since you wont have any copays when visiting the doctor or. The only other difference between Plan N and Plan G is that Plan G will pay doctors excess charges. In most states Plan G generally runs about 20-25 more per month than Plan N More about Plan G prices.

When you compare Plan G vs Plan N youll see that Plan G comes with more coverage. Plan G and Plan N offer almost everything Plan F offers. Plan G will offer a high deductible option beginning January 1 2020.

Plan N includes the following. All the benefits of Plan F expect Part B excess charges AND Part B deductible. Videos you watch may be added to the TVs watch history and influence TV.